Enhance your financial protection with smart home insurance.

Improving your financial protection is a necessity in today's world, and smart home insurance is an excellent solution. These products not only safeguard your assets but also adapt to your specific needs, providing peace of mind and security. In this article, we will explore how this insurance can transform your approach to personal finance and protect what you value most in your life. Discover how to optimize your financial security intelligently!

What are smart home insurance policies?

Smart home insurance is an evolution in the way homeowners manage the protection of their assets. Unlike traditional insurance, these products incorporate advanced technology and customization to provide coverage that is more tailored to the specific needs of each home. For example, many policies now allow policyholders to access digital tools that facilitate the management of their insurance and the monitoring of risk situations in real time. This means that, instead of a generic approach, you can have a plan designed specifically for you and your environment.

Additionally, smart insurance often includes extra features that promote risk prevention and mitigation. This can range from connected devices that monitor conditions such as humidity or temperature to automatic alerts in potentially dangerous situations. In this way, it's not just about being protected after damage occurs; it's also about preventing it before it happens. This proactive approach not only enhances your peace of mind but can also lead to significant savings by reducing claims and premiums associated with future incidents.

2. Benefits of hiring a smart home insurance

Hiring a smart home insurance offers a range of benefits that go beyond simple financial protection. One of the most notable aspects is the customization of coverage, allowing you to tailor the insurance to the specific characteristics and needs of each home. This means you can choose to insure against the risks that are most relevant to your particular situation, from water damage to theft, ensuring that you are protected where you need it most. This flexibility not only optimizes your insurance expenses but also gives you a sense of control over your financial security.

Additionally, many smart home insurance policies incorporate advanced technology that facilitates the management and monitoring of your policy. Some companies offer mobile apps that allow you to track your coverage and claims in real-time, as well as receive alerts about potential risks in your home. This technological integration not only enhances the user experience but can also help you prevent significant losses by providing crucial information for making quick decisions. In summary, opting for smart home insurance is not only an investment in protection; it is also a step towards greater peace of mind and comprehensive security in your daily life.

3. How to choose the best home insurance for you

Choosing the best home insurance is a process that requires attention to specific details. The first thing you should consider is the value of your belongings and the coverage needed to protect them adequately. Evaluate the cost of rebuilding your home, as well as the value of your personal possessions. Ensure that the policy covers not only damages from fires or thefts but also natural disasters such as floods or earthquakes, depending on the geographical location you are in. This will give you a clear view of what type of protection you need and how it aligns with your financial situation.

Another crucial aspect is to compare different options in the market; not all insurers offer the same conditions or prices. Research additional coverages that may be relevant to you, such as home assistance, liability insurance, or even tailored insurance for valuable items. Additionally, pay attention to the opinions and experiences of other policyholders regarding customer service and the speed of claims processes. Taking the necessary time to analyze these variables will lead you to make a more informed decision that aligns with your financial and personal needs.

4. Comparison between traditional insurance and smart insurance

Traditional insurance has long been the preferred option for home protection, offering standardized coverage that fits the general needs of homeowners. However, these products may lack flexibility, meaning you could be paying for coverage you don't need or falling short in essential areas. On the other hand, smart insurance is designed to adapt to your particular circumstances, allowing for complete customization of policies. This not only optimizes the cost of insurance but also ensures that every critical aspect of your home is adequately protected.

One of the key differences between traditional insurance and smart insurance lies in the use of advanced technology. Smart insurance often incorporates digital tools and data analytics to assess specific risks and offer personalized recommendations. This means you can receive alerts about potential dangers in real-time and advice on how to mitigate those risks. In contrast, traditional insurance tends to be more reactive; that is, it only responds when a claim occurs. By choosing smart insurance, you are investing in a proactive solution that not only protects your home after the fact but continuously works to keep it safe and secure before any eventuality.

5. Case studies: success stories with smart home insurance

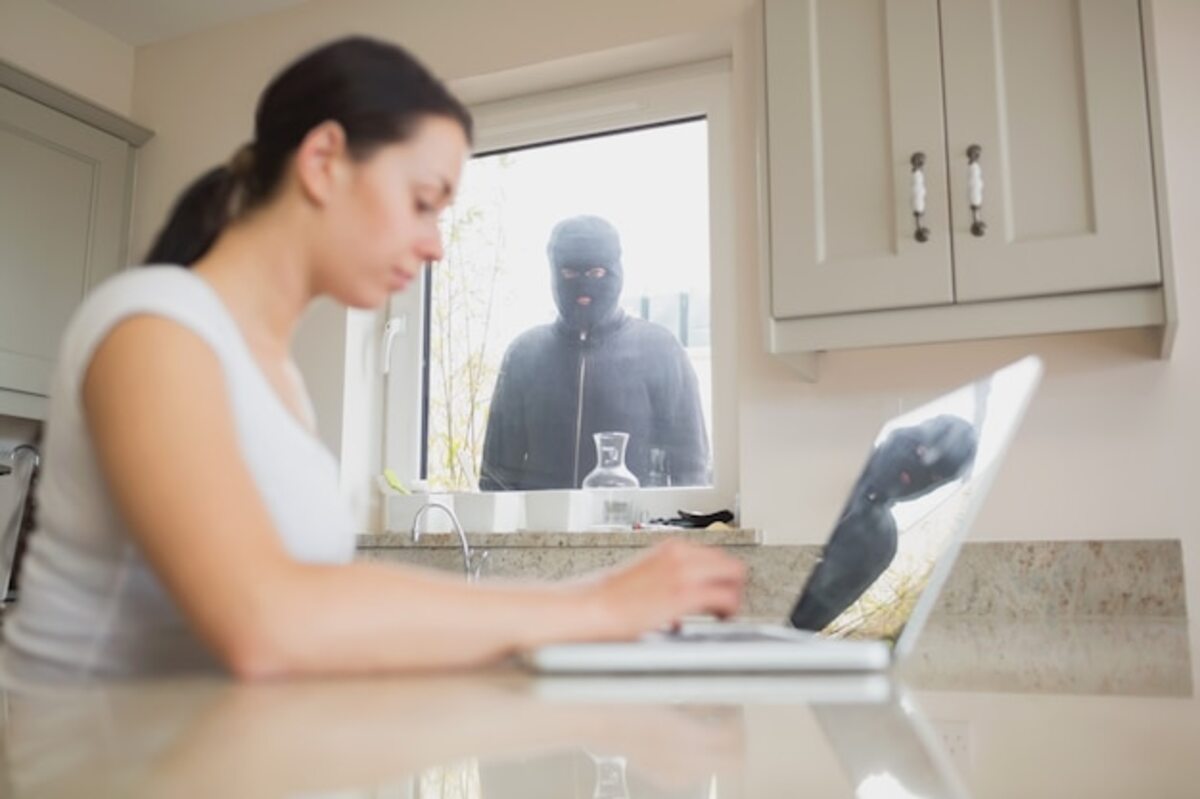

One of the most inspiring success stories with smart home insurance is that of the Martínez family, who decided to implement a smart monitoring system in their house. After experiencing a burglary in their neighborhood, they opted for insurance that not only covered material damages but also offered discounts for the installation of security devices. Thanks to this integration, they managed to reduce their monthly premium and, at the same time, enjoy greater peace of mind knowing that their home was protected. On one occasion, due to the real-time alerts from the system, they were able to prevent an attempted break-in and quickly notify the authorities.

Another example is that of the Gómez couple, who purchased a smart home insurance policy that included protection against natural disasters. After experiencing an unexpected flood, they realized how essential it was to have specific coverage tailored to their circumstances. Their policy not only allowed them to recover financially their lost belongings, but also provided them with advice on how to improve the infrastructure of their home and better protect themselves against future incidents. This experience taught them the importance of choosing an insurance that not only meets their current needs but also proactively adapts to potential risks in the future.

6. Tips to maximize your home insurance policy

To maximize your homeowners insurance policy, it is essential to create a detailed inventory of your belongings. This will not only help you determine the total value of your assets but also streamline the process in case of a claim. Be sure to document each valuable item with photos and lists that include details such as brands, models, and prices. Clarity in your inventory can prevent undervaluations or misunderstandings with your insurer, ensuring that you receive the appropriate compensation in adverse situations.

Additionally, review your policy periodically to ensure it aligns with changes in your life and assets. As you acquire new belongings or make improvements to your home, it's essential to update your coverage to reflect these changes. Don't hesitate to consult an insurance agent for recommendations on additional coverages or necessary adjustments. Also, consider bundling policies (such as auto and home) with the same company to receive significant discounts. By taking these steps, you'll be better positioned to fully benefit from your policy and protect what you value most.

7. Future of home insurance: emerging trends and technologies

The future of home insurance is shaping up as a convergence of emerging technologies and innovative trends that will redefine how homeowners manage their financial protection. With the rise of the Internet of Things (IoT), it is increasingly common to see connected devices that monitor the state of the home in real time, from smoke detectors to security cameras. These tools not only enhance safety but also enable insurers to offer customized policies based on concrete data about individual customer behavior and needs. The integration of these devices can lead to significant discounts on premiums, fostering a proactive approach to risk prevention.

Furthermore, artificial intelligence and predictive analytics are revolutionizing the claims process and risk assessment. Insurers can anticipate potential adverse events through advanced algorithms that analyze historical patterns and current environmental conditions. This not only minimizes the time required to resolve claims but also enhances the customer experience by providing faster and more accurate responses. As these technologies continue to evolve, smart home insurance will become a fundamental ally for solid and effective financial planning, thereby ensuring comprehensive protection against unforeseen events.